Get your

Marksman Liquidity Hub Solution

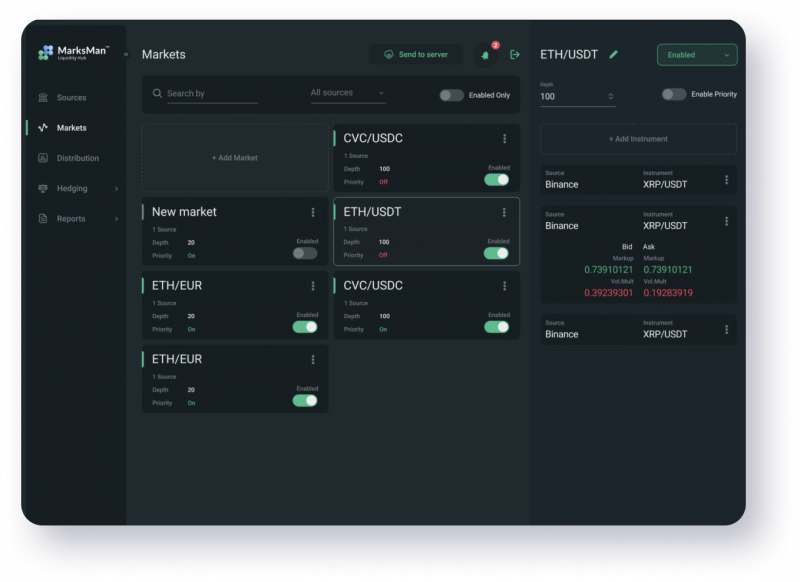

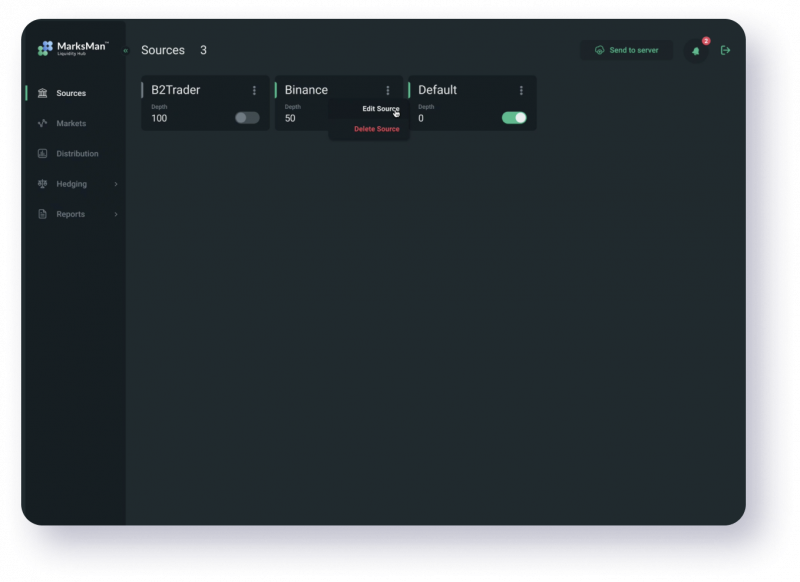

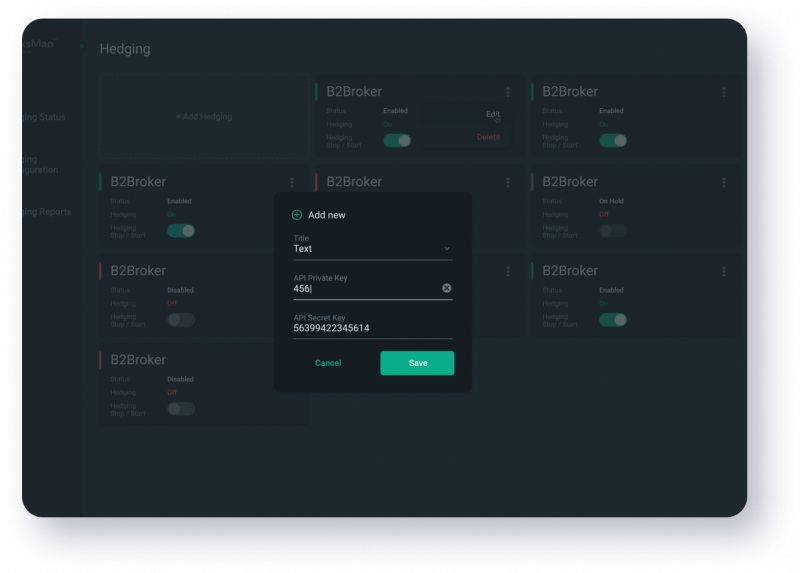

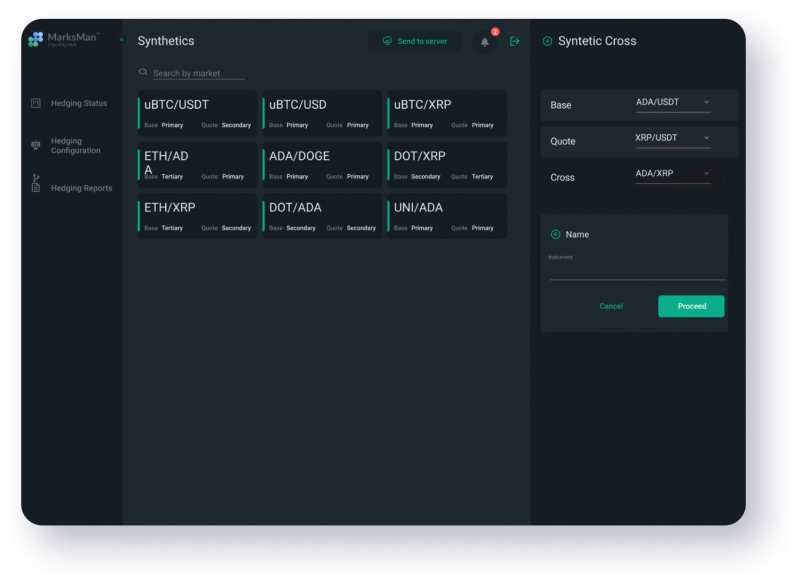

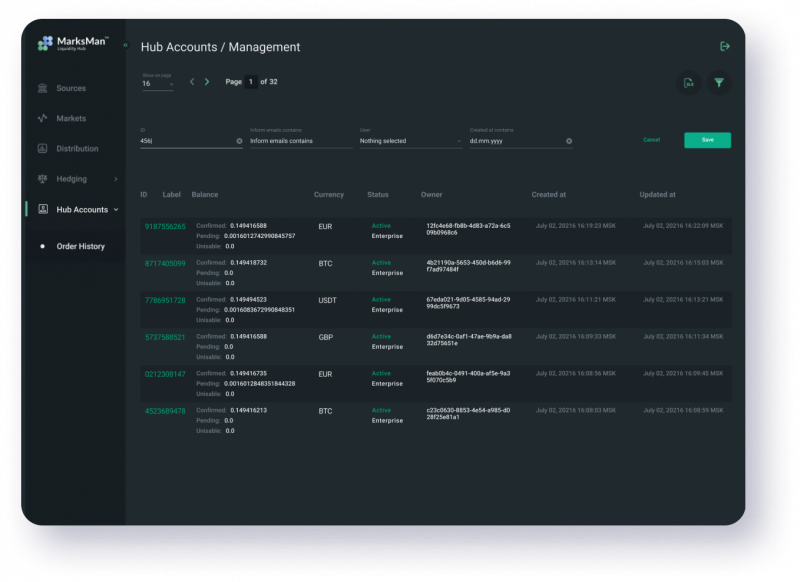

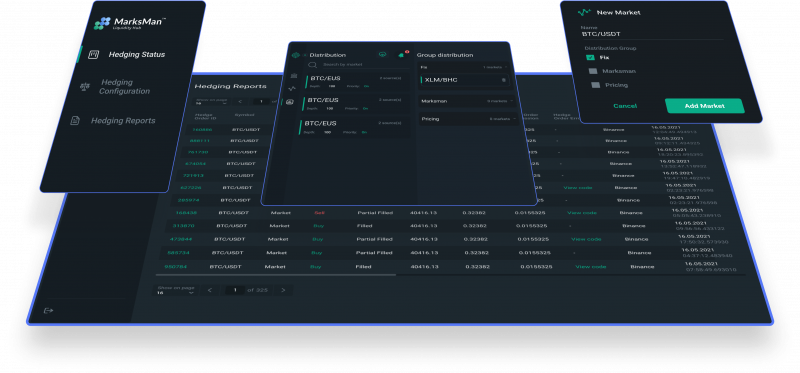

Fast and simple access to liquidity pools on major crypto exchanges. Aggregation, hedging, mapping of symbols, synthetic instruments, risk parameters. All these and many more other features are available.

Contact us

What is MarksMan

MarksMan Liquidity Hub enables retail and institutional brokers as well as crypto-exchanges, to deliver the best possible trading experience to their customers. The product provides a set of services for access to spot liquidity of digital assets and other trading instruments.

MarksMan supplies top-of-the-book and full market depth pricing, as well as includes simple yet powerful price construction and risk hedging features.

Fast Setup in

10 days

Connectivity

FIX / WSS / REST

Technical Support

24/7

Our Ecosystem

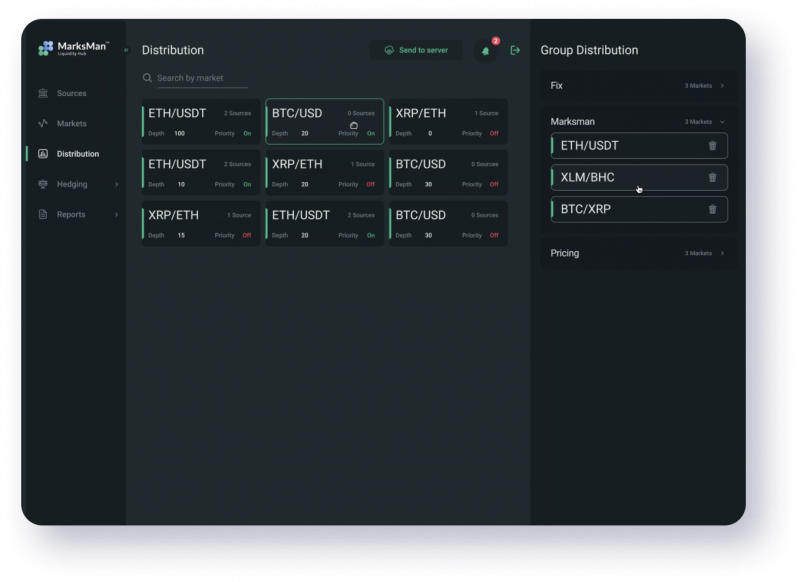

MarksMan Ecosystem is a network of platform-accredited Liquidity Providers and Client Venues, which enables the taker and maker participants to receive liquidity from any sources and supply it to any destination via price feeds.

Such sophisticated yet efficient ecosystem interchange delivers an unparalleled user experience, revenue opportunities, and risk mitigation provisions.

Tap on picture to zoom

Ecosystem Takers

Taker Venues (or Clients) can use MarksMan to connect their exchange or broker trading platforms to a vast range of liquidity providers to aquire price feeds and hedge price risks.

By connecting to both ecosystem-supported and external LPs, Takers can have a better selection of trading instrument quotes with improved market depth, and more flexibility in how they hedge their risks.

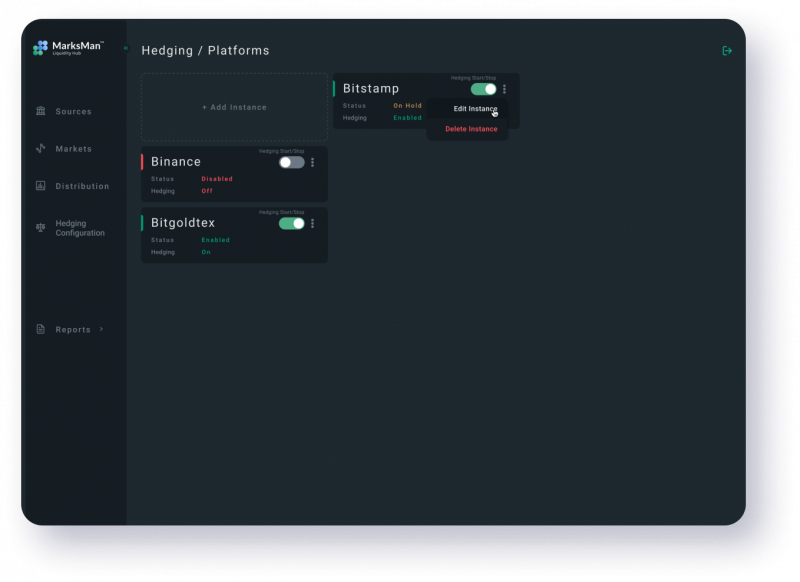

Ecosystem Makers

As key players in the Ecosystem, Makers (Partners) help to maintain great liquidity for clients by providing quality price feeds and best price execution opportunities.

By joining the Ecosystem List, they commit to supplying liquidity for client instances, ensuring that the trading continues to be smooth and effective.

Liquidity Providers

Tap on picture to zoom

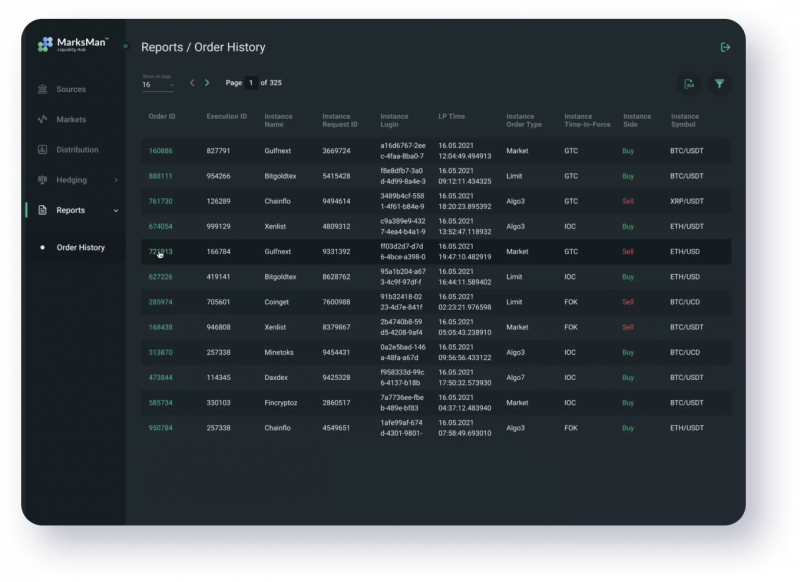

Our offerings come with comprehensive documentation, API references, and useful information.

Package solutions are tailored to help potential clients pick the one that’s most appropriate for their business needs.

Tap to zoom