MarksMan liquidity hub is a complex ecosystem that empowers retail brokers, institutional brokers, and crypto exchanges to deliver or obtain liquidity, ensuring the smoothest trading experience possible.

The platform offers a variety of options for obtaining entry to spot liquidity for digital assets and other trading products. MarksMan offers top-of-the-book and full market depth pricing, as well as price construction and risk hedging capabilities that are simple yet effective. This solution is quick and easy to set up, taking up to 10 business days. Besides that, the solution offers user-friendly technical assistance 24 hours a day, seven days a week.

MarksMan is the ideal option for all market participants in the world of digital assets. This liquidity solution provides everything you need, including capacity for spot and perpetual futures liquidity, as well as simple access to liquidity pools on major crypto exchanges. MarksMan also supports aggregation, hedging, symbol mapping, synthetic instruments, risk indicators, and other tools.

Let’s find out what this top-quality liquidity supplier has to offer.

But before that, we need to discuss why it’s so crucial for traders and brokers to have sufficient liquidity.

The Importance of Liquidity and How to Provide It

Financial markets need liquidity to function properly, whether it’s crypto, Forex, or any other type of market. Without liquidity, these markets would grind to a halt, as buyers and sellers would be unable to find each other to complete trades.

Deep liquidity on a trading platform is essential for achieving narrow spreads, excellent execution times, high-quality fill volumes, and reduced slippage. Because of that, everyone who participates in trading strives for the highest level of liquidity possible.

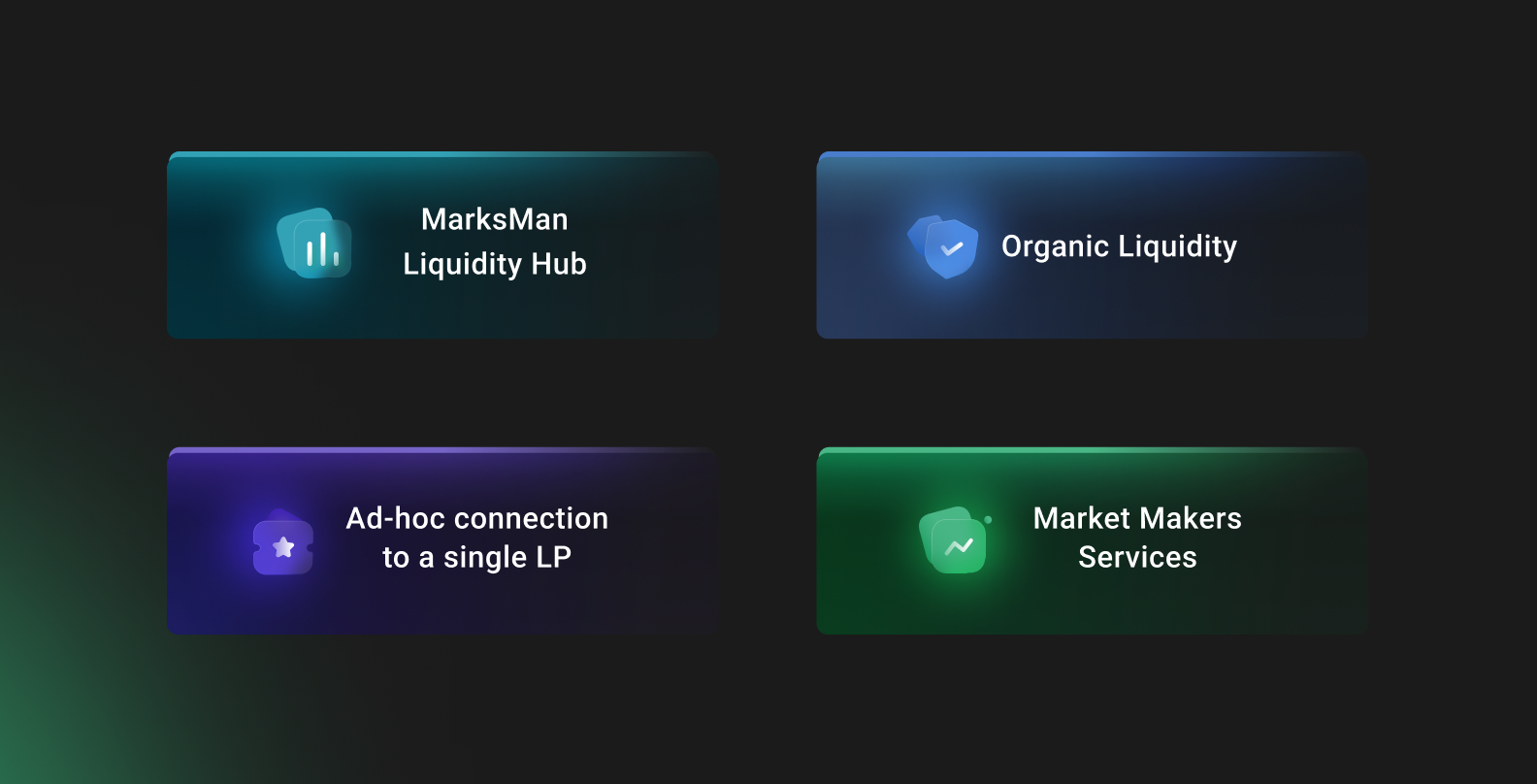

Currently, there are various methods for providing liquidity. First and foremost, there is organic liquidity, which is the best option for exchange platforms. Organic liquidity is formed when many traders come to the platform and start trading with many different assets. That makes trading possible for every participant. However, organic liquidity is difficult to obtain and maintain since it requires a lot of people to be trading on the platform at the same time.

One of the most popular ways to address this issue and ensure adequate liquidity on your platform is to use market makers. However, this sort of service is quite costly, and the market maker’s definition of risk may not match up with your own. In times when volatility hits the market and spreads expand, market makers are less likely to be able to provide the same level of service, leading to unpleasant results.

Another option is to connect to a single or a few liquidity providers on a constant basis. This way, you obtain level 2 quotes from a liquidity supplier and keep a local order book on your platform. Such a procedure is significantly less expensive than working with a market maker. However, such a solution also has its drawbacks. For example, a liquidity provider can go on maintenance, or some network failures could happen, leading to the price feed being missing. In that case, you will have to seek additional methods to satisfy customers.

A liquidity hub is another way to get liquidity on a platform, which many exchanges consider the most convenient and reliable option because it solves many problems that are characteristic of other types of liquidity provision. Let’s see what a MarksMan liquidity hub can do.

What is Liquidity Hub? MarksMan’s Capabilities

Price Discovery

MarksMan conducts price discovery with the help of its price discovery engine, which can link to many Level 2 quote sources simultaneously. These sources are usually different crypto exchange platforms and other liquidity suppliers and market data aggregators. The engine discovers top-of-the-book prices, as well as full-depth order books for any assets traded on global markets.

In order to do it, the MarksMan liquidity hub uses different APIs (REST, Public, Private, Websocket) and the FIX protocol to support these connections. Moreover, you can request developers to create a custom API for your specific needs. Different adapters ensure that you can get any package price for every accessible asset.

Price Construction

One of the major benefits of the MarksMan liquidity hub is that it allows you to fine-tune liquidity streams by configuring trading instruments and order books at the granular level.

- Markups

For example, you can impose specific markups on the order book to control market risk. This will allow you to experiment with spreads to attract more consumers.

- Order Book Depth

MarksMan also allows you to control the order book depth of your platform. As already mentioned, your platform connects to multiple liquidity providers, which may supply you with quotations of varying levels, so regulating the level of order book depth is indeed useful.

- Decimal Precision

Also, this liquidity hub allows you to configure the decimal precision of the instrument. As you aggregate the market data from different sources, some instruments can be five digits, and assets from other platforms can be eight digits. In this situation, such a feature becomes very important.

- Volume Modifiers

Remember that the order book depth depends on the platform. Some support dozens, while others support hundreds or even thousands of pricing levels in their order books. As a result, you may want to regulate the amount of the volume you supply at each pricing level. That is exactly what the MarksMan liquidity hub can provide you.

- Symbol Mapping

Furthermore, there are several methods for so-called symbol mapping, which is a very beneficial feature. With this functionality, you can rename trading instruments to your preference and not just that. You may also enable one group of your users to trade a specific symbol with one set of parameters and another group of users to trade the same asset with a different set of parameters.

Synthetic Instruments

One of the key features of the MarksMan solution is its ability to create synthetic instruments. This allows you to engineer your own trading pairs that are not available by liquidity sources. There are many options to make such instruments: for example, you can combine two pairs and offer the synthetic cross of them, create an entirely new artificial pair, or provide users with fractional instruments.

Using MarksMan, you can create as many synthetic combinations as you like to reflect your trading view and expand your offerings.

How Does Liquidity Distribution with MarksMan Work?

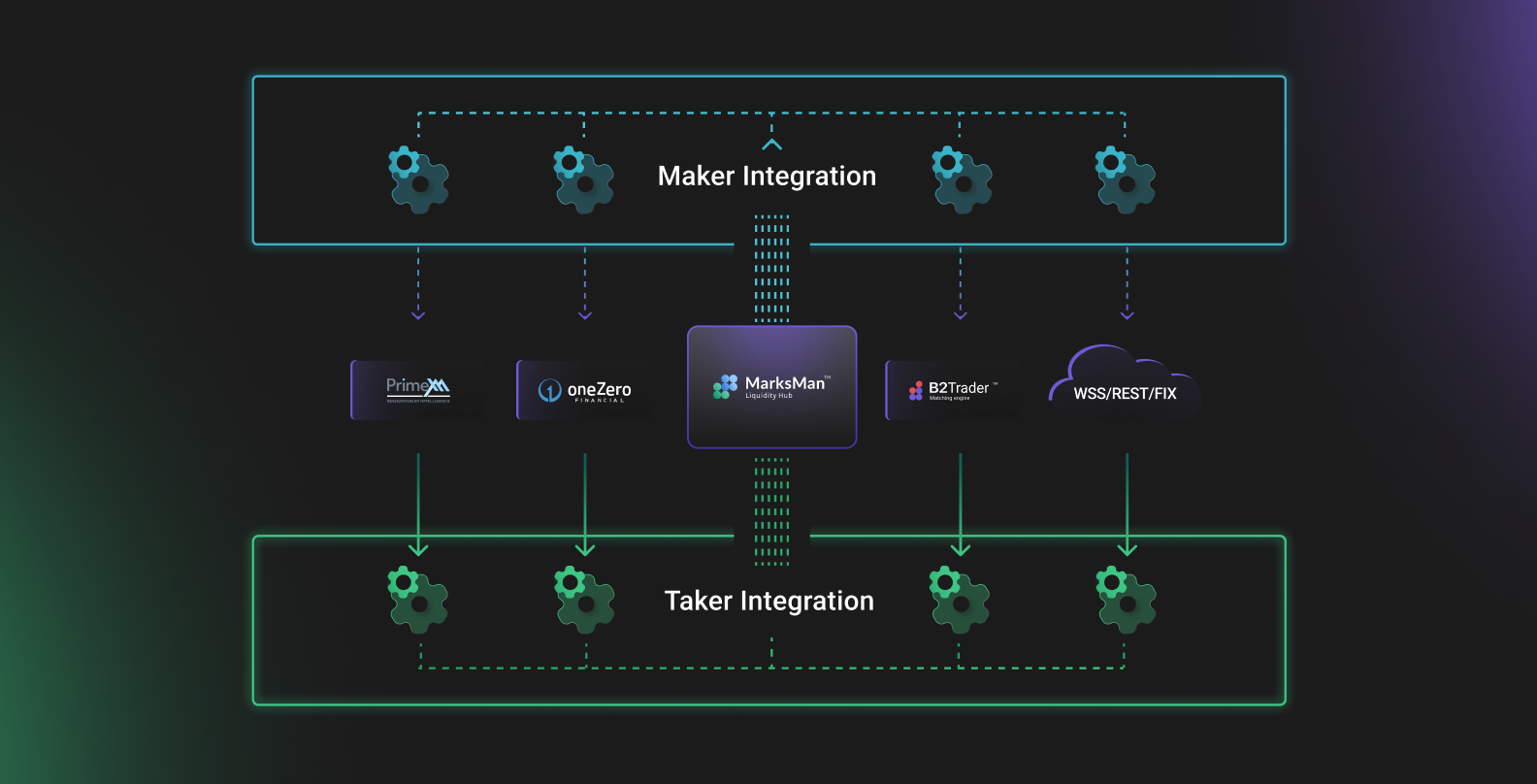

Now that you are more familiar with the MarksMan liquidity hub’s capabilities, it’s time to discuss liquidity distribution. First of all, it is critical to distinguish between two types of integrations of liquidity distribution.

1) Maker integration

The maker integration is a model where a maker platform supplies the quotation price feed to the liquidity hub. Then, the liquidity hub applies various price construction parameters to this received order book based on the client’s wishes. After that, this pricing information is streamed to the taker platforms, where the taker’s users trade against this order book.

2) Taker integration

In contrast to the maker, the taker receives the price feeds from the liquidity hub. Then, the taker sends back the trades outcomes to the hub, where makers execute these trades on their platforms.

This system is highly flexible, as it allows for a variety of different scenarios. Let’s say some maker provides quotes for metals and fiat currencies to the liquidity hub. And at the same time, this maker can receive quotes for crypto assets from other makers. From there, this participant has the option to create his own synthetic pairs by combining his own liquidity with the newly obtained one.

Therefore, any platform, whether it is an exchange or broker, can be linked to a liquidity hub in both roles: as a maker to provide the liquidity for other venues or as a taker to obtain this liquidity, providing its users with liquidity to trade.

MarksMan liquidity hub can offer you connectivity with the most prominent liquidity providers and liquidity hubs in the industry through WebSocket, REST, or fixed APIs.

Risk Hedging

If your platform has deep organic liquidity or if you use a market maker, who handles all the risks, market risks on your platforms are low or non-existent. However, if you use a liquidity hub, users on your platform trade against your order book; therefore, each trade will carry a certain market risk. So, you have a choice — internalize this risk or hedge it to a certain extent.

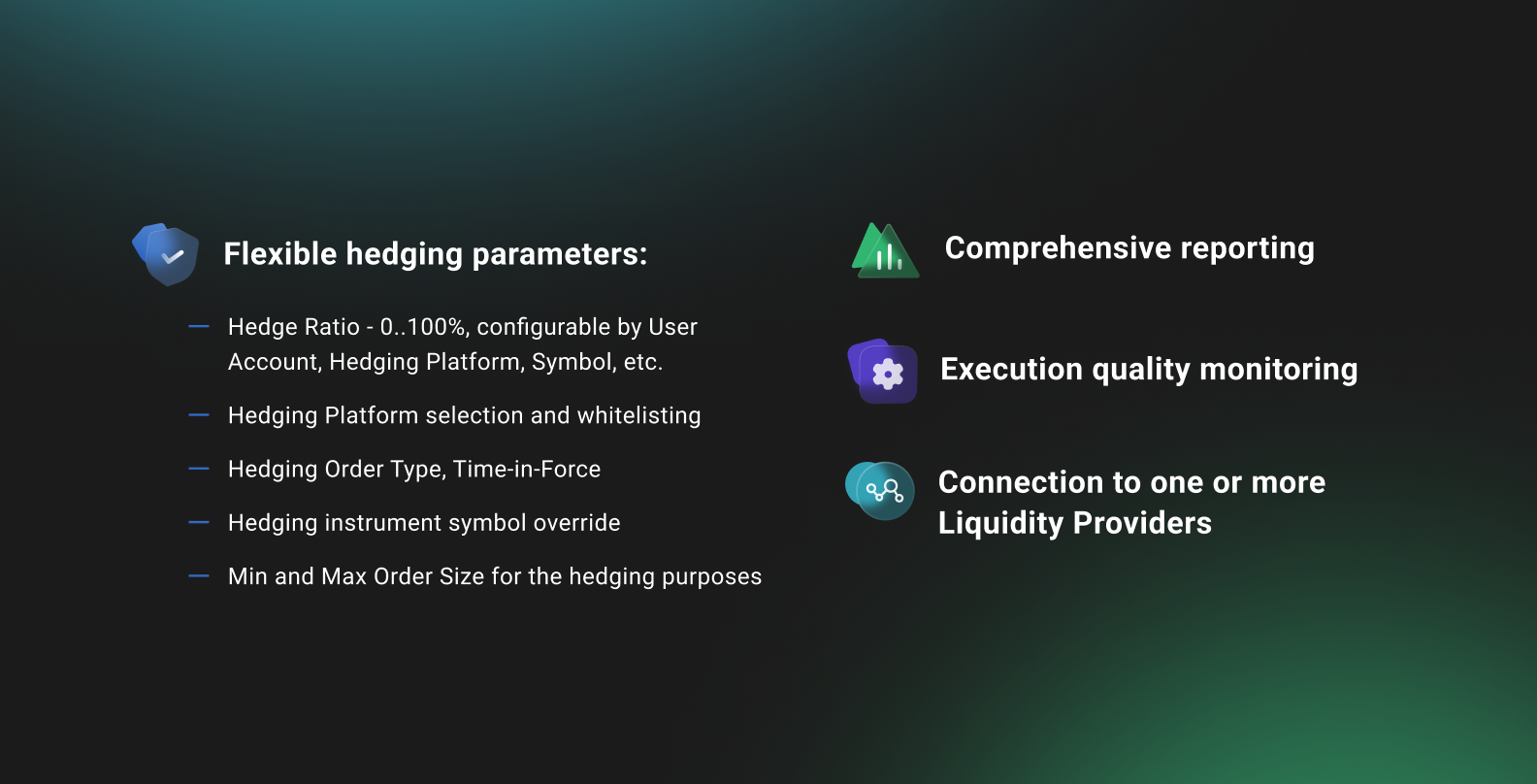

The MarksMan liquidity hub allows you to hedge your liquidity automatically by providing many flexible configurations of hedging parameters.

Hedging Parameters

One of the parameters is a hedge ratio. You may hedge your market risk for each transaction automatically and apply a hedging ratio ranging from 0% to 100%. In reality, you may even hedge at 120% or higher. But that’s not all. Hedging ratios can be customized based on trading symbols — you can assign a specific hedge ratio for one symbol and another ratio to another symbol.

Hedging can also be done depending on the platform, which means that you can set certain hedging rules for certain liquidity sources. Or you can configure hedging depending on a user account.

Additionally, MarksMan allows you to set up your own hedge order types, and you also have the option of hedging one trading instrument with another trading instrument. For example, you can hedge a crypto-fiat pair with crypto-crypto, which may be a very flexible way to hedge risks in specific scenarios.

Also, you can set your own minimal and maximum order sizes for hedging purposes. For example, if hedging very small orders is inconvenient for you and you want to handle things differently, you can manually handle orders that exceed a certain order size.

In sum, there is no doubt that MarksMan offers incredible flexibility when it comes to hedging.

Using risk hedging is possible for both exchanges that use matching engines and brokerages. If you own a brokerage platform, you can connect it to the liquidity hub as a taker, get the price fee, and then, when the user places the order, you can send this order for execution to the liquidity provider via the liquidity hub. After the trade is executed, you receive a report with the execution characteristics to provide to your trader. In this scenario, the brokerage platform doesn’t take any market risk because liquidity providers execute orders for you.

Hedging Policies

You may hedge your user’s trades with spot or instead use perpetual futures contracts. Using perpetual futures is a good strategy when you know your margin needs, and in some instances hedging spot liquidity with derivatives is much cheaper.

MarksMan also enables you to implement your own hedging policy. You can assign various user profiles to different hedging configurations. In addition, you can maintain the hedging ratio for trading instruments and individual users or user groups. This way, you can effectively apply your hedging policy and properly manage your market risk automatically, all through a web-based interface.

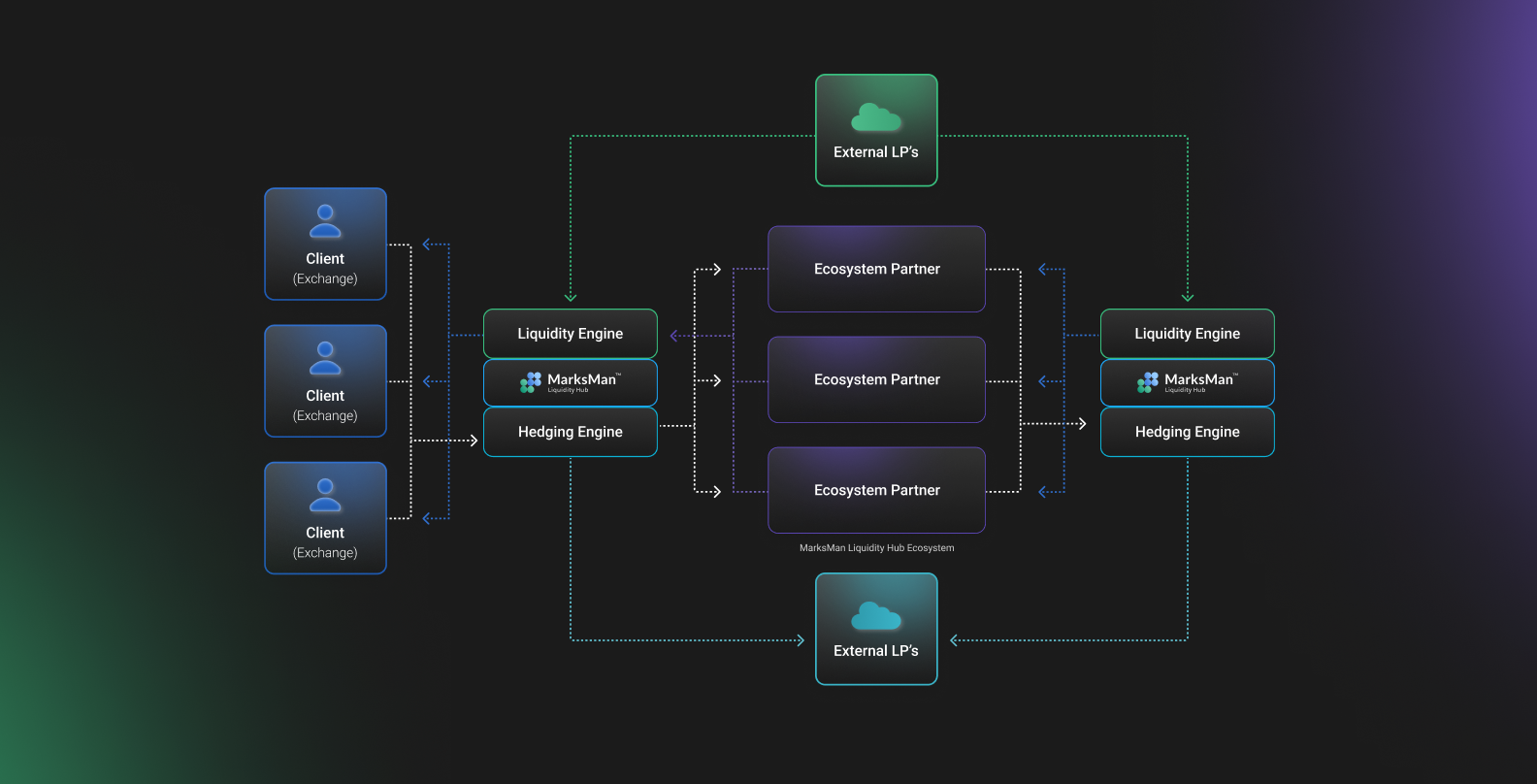

What is The MarksMan Liquidity Hub Ecosystem?

The core MarksMan liquidity hub is just one component of an enormous MarksMan Ecosystem that encompasses many elements. Let’s take a closer look at how this Ecosystem is structured.

As was already mentioned, platforms can play either a maker role by delivering liquidity to other venues or a taker role by obtaining liquidity from makers.

However, there is one more layer to that. Maker platforms can be divided into external liquidity providers and ecosystem partners. As of now, MarksMan has one ecosystem partner — B2BX, a prominent exchange for institutional and corporate clients. Nevertheless, B2Broker hopes to attract other exchanges as ecosystem partners in the future. The main benefit of ecosystem partners for client exchanges is that partner’s traffic is free of volume charge. The volume charges are only applied for hedging on external liquidity providers.

If you are interested, you can visit the MarksMan website to discover in detail all the available external liquidity providers connected at the moment.

MarksMan Ecosystem is excellent because it allows you to serve as an ecosystem partner and provide liquidity for certain trading instruments, which can be useful to other takers, and, at the same time, you can ensure that you have sufficient liquidity for specific assets on your own exchange by taking this liquidity from other makers. It’s a win-win situation for everyone involved.

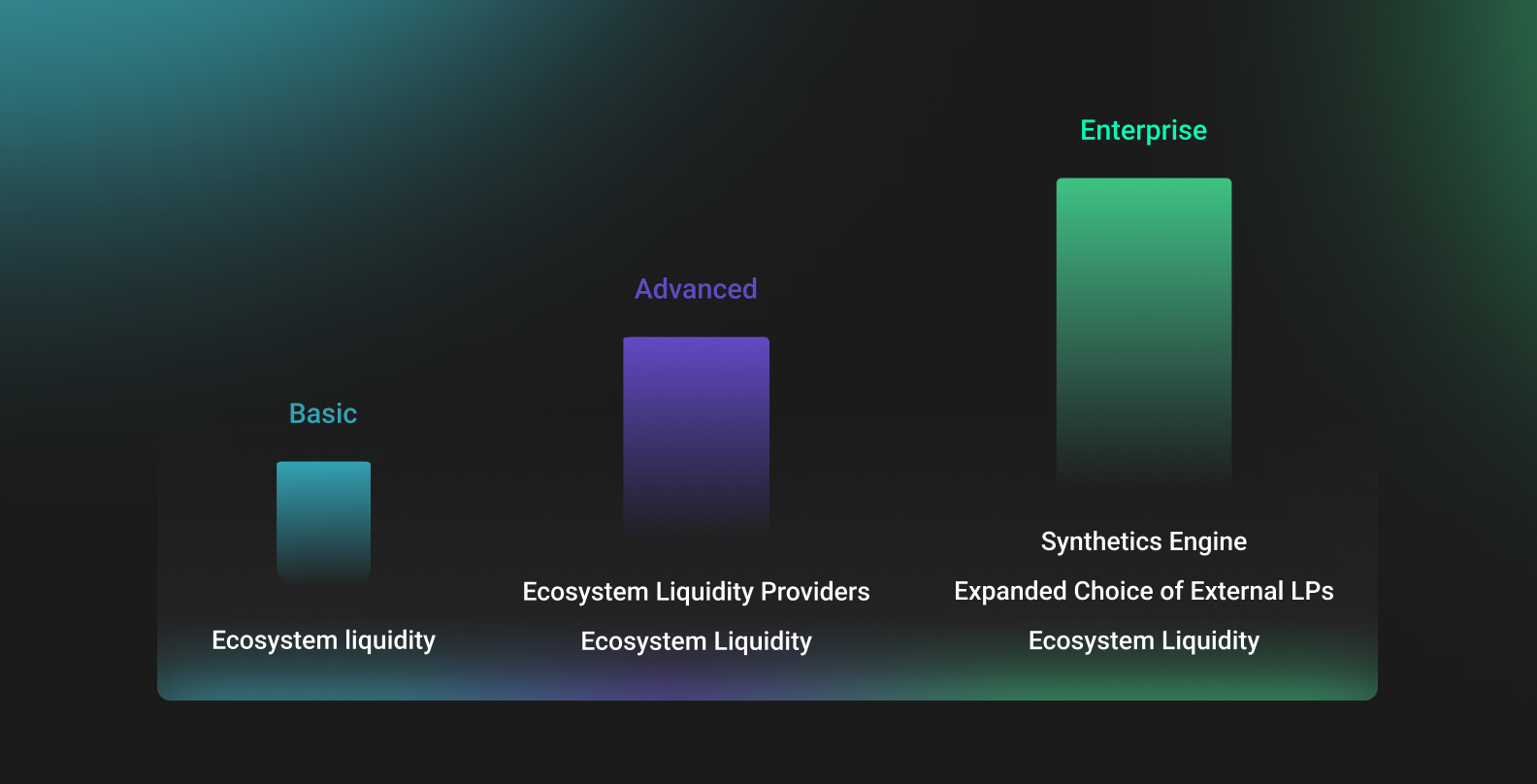

Packages

MarksMan comes in different packages, with each having its own fees and conditions. If you are a client exchange, you may consider a package that better suits your specific liquidity requirements and cost constraints.

- Basic

The basic package includes only ecosystem liquidity and has a monthly charge for using the infrastructure. This fee can be considered one of the most affordable options in the industry regarding liquidity pricing.

- Advanced

Next, if you would like to have access to more liquidity, there is the advanced package for you, which includes connectivity to external liquidity suppliers along with ecosystem liquidity. Hedging of external providers entails an additional volume charge.

- Enterprise

Lastly, there is an enterprise package that includes a synthetic engine in addition to a broad range of external liquidity providers. This is the complete package that will provide the platform with the entire list of functionality and hedging capabilities.

Technology and Concluding Remarks

MarksMan serves as a SaaS (software-as-a-service) liquidity solution. This is because the liquidity hub provides clients with some data in addition to the platform itself. However, you don’t have to rely on this data since you can use the fixed API to connect to whatever maker you want. Therefore, MarksMan can be considered PaaS (platform-as-a-service) since the client will be the one who provides data.

The advanced Go programming language underpins the entire technology behind this cloud-native solution. In addition, MarksMan employs its own library developed by the B2Broker team for implementing the FIX protocol. The source code for this library is available on GitHub for everyone who wants to use it for integration purposes.

The team behind the project is represented by a group of skilled professionals ready to assist you with any questions. You will receive assistance straight from the platform, and you will be allocated a personal manager who speaks your language.

Thus, the MarksMan liquidity hub solution offers various innovative features to make it easier for clients to obtain and manage liquidity. The platform’s main capabilities include aggregation, hedging, symbol mapping, synthetic instruments, and risk parameters. All of these options are available on a single platform, giving you access to world-class liquidity pools for a broad range of instruments.